The 6:00 a.m. Tax Realisation (And the Tool That Turns Dread Into Strategy)

It’s a grey British Sunday. Kettle on. Everyone else in the house is asleep. You open your payslip (again) and feel that quiet, familiar annoyance: “I earn how much—and keep how little?”

You’ve heard of the 40% band, maybe even the 45%. But nobody warned you about the invisible cliffs:

- The personal allowance taper past £100k.

- That weird effective 60% zone.

You’re not reckless. You’re just busy. And the system’s opacity quietly taxes that, too. Let’s do some vibe coding to understand this mess

Why This Project Exists

This project was born at 6:00 a.m.—a small rebellion against guesswork. Not a spreadsheet beast. A clear, visual UK tax optimisation companion that answers three deceptively simple questions:

- Where’s my money actually going?

- What am I losing that I could legally keep?

- What levers change the outcome fastest?

The Problem: Fog, Not Numbers

Most people can quote their gross salary. Fewer know:

- Their true average vs marginal effective rate.

- How much tax + NI + tapered allowances quietly remove.

- Whether a pension contribution would recover lost personal allowance or retain Child Benefit.

- That salary sacrifice (pension / EV / cycle) can save NI as well as tax.

We don’t have a shortage of calculators. We have a shortage of clarity.

The Experience

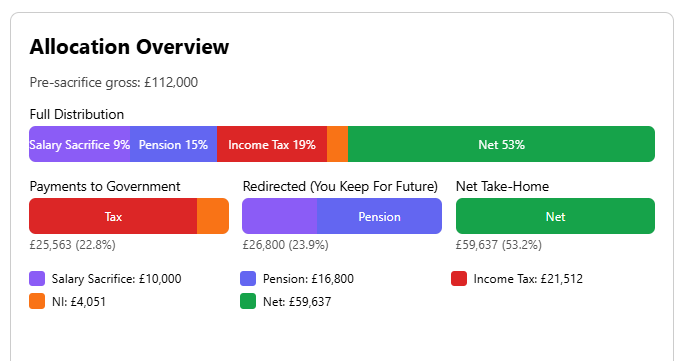

Instead of dumping a number at you, the tool stacks your whole pre-sacrifice gross into coloured bands:

- Payments to government (Income Tax, NI, Child Benefit charge)

- Redirected (salary sacrifice, pension)

- What you genuinely take home

You drag a pension percentage and instantly watch tax shrink, marginal cliffs flatten, effective relief rates jump. Add a salary sacrifice (future EV or cycle) and you see the difference—not in abstract percentages—but in reclaimed annual pounds.

It reframes pension from “money I lose today” to “money I redirect while unlocking tax efficiency.”

Key Moments It Surfaces

- “That extra bonus pushes me into losing £X of personal allowance.”

- “Another 3% pension here is effectively 55–65% ‘off’ because it restores lost allowances.”

- “My NI hasn’t moved—right, because this is a straight employee contribution, not sacrifice.”

- “If I sacrifice instead, both tax and NI fall. That’s real cash back.”

Why This Matters (Beyond the Numbers)

Understanding your tax position:

- Reduces anxiety (uncertainty is a tax on attention)

- Improves negotiation (know what part of a raise you’ll actually keep)

- Accelerates long-term wealth (high-relief pension £ buys more future optionality)

- Protects family benefits (Child Benefit erosion is stealthy)

- Encourages intentional trade-offs (EV vs cash allowance vs bonus timing)

A Glimpse Under the Hood (Light Touch)

A pure calculation engine crunches:

- Personal allowance taper (£1 lost per £2 over £100k)

- Child Benefit charge (1% per £200 in the £60k–£80k band)

- NIC bands

- Pension effect on taxable income (employee) vs NI-able income (sacrifice)

Then it generates a composable JSON breakdown feeding stacked visual bars and savings summaries. No spreadsheets. No black box.

Here are the tax rules used by the engine - let me know if you think there is anything wrong

// Centralized thresholds & rates (easier future updates)

// NOTE: Adjust once official 2025/26 figures confirmed.

export interface IncomeTaxBand {

from: number;

to?: number;

rate: number; // e.g. 0.2

}

export const PERSONAL_ALLOWANCE = 12_570;

export const PERSONAL_ALLOWANCE_TAPER_START = 100_000;

export const PERSONAL_ALLOWANCE_TAPER_LOSS_PER = 2; // lose £1 per £2

export const PERSONAL_ALLOWANCE_FLOOR = 0;

// Bands here are applied to taxable income AFTER personal allowance.

// We express band spans relative to 0 taxable amount after PA.

export const INCOME_TAX_BANDS: IncomeTaxBand[] = [

{ from: 0, to: 37_700, rate: 0.2 }, // Basic (after allowance)

{ from: 37_700, to: 125_140 - PERSONAL_ALLOWANCE, rate: 0.4 }, // Higher

{ from: 125_140 - PERSONAL_ALLOWANCE, rate: 0.45 } // Additional

];

// National Insurance (Employee, Class 1) – assumed continuing rates

export const NI_PRIMARY_THRESHOLD = 12_570;

export const NI_UPPER_EARNINGS_LIMIT = 50_270;

export const NI_MAIN_RATE = 0.08; // 8%

export const NI_ADDITIONAL_RATE = 0.02; // 2%

// Child Benefit amounts (assumed carryover; update when official)

export const CHILD_BENEFIT_FIRST_CHILD_WEEKLY = 25.60;

export const CHILD_BENEFIT_ADDITIONAL_CHILD_WEEKLY = 16.95;

export const CHILD_BENEFIT_YEAR_WEEKS = 52;

// High Income Child Benefit Charge updated thresholds

export const CHILD_BENEFIT_CHARGE_START = 60_000;

export const CHILD_BENEFIT_CHARGE_END = 80_000; // fully removed by here

export interface TaxSystemConfig {

taxYearLabel: string;

}

export const CONFIG: TaxSystemConfig = {

taxYearLabel: '2025/26 (assumed)'

};

Common “Aha” Examples

- £115k salary, modest pension → allowance taper spike. Increase pension % → reclaim allowance, huge relief.

- Mid-£60k earner with two kids → Child Benefit leakage. A tweak in sacrifice brings back family cash flow.

- EV salary sacrifice modelling (coming next) → Net cost far lower once Tax + NI + low BiK rate is shown.

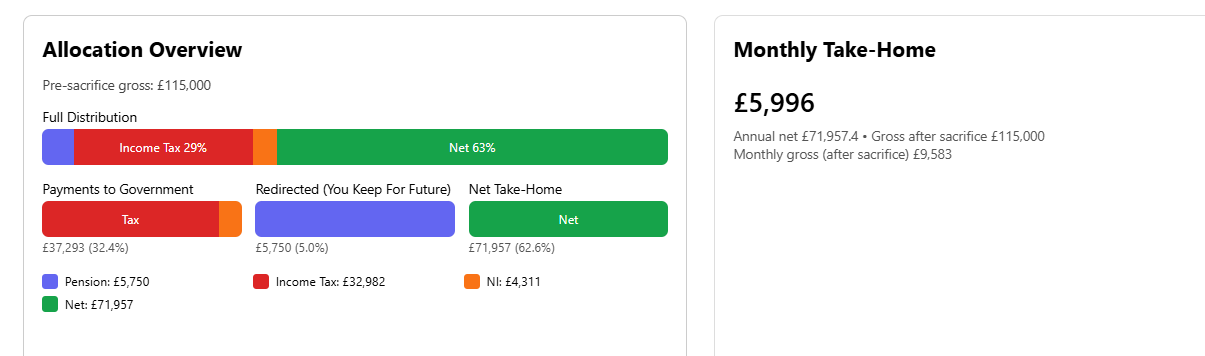

Dig into the £115k Salary Example

Let’s walk through a classic “aha” scenario:

Suppose your salary is £115,000 and you’re making only 5% pension contribution. At this level, you’re well into the personal allowance taper zone—meaning for every £2 you earn above £100,000, you lose £1 of your tax-free allowance. The result? Your effective tax rate on this band can spike to 60% or more. Just look at those numbers

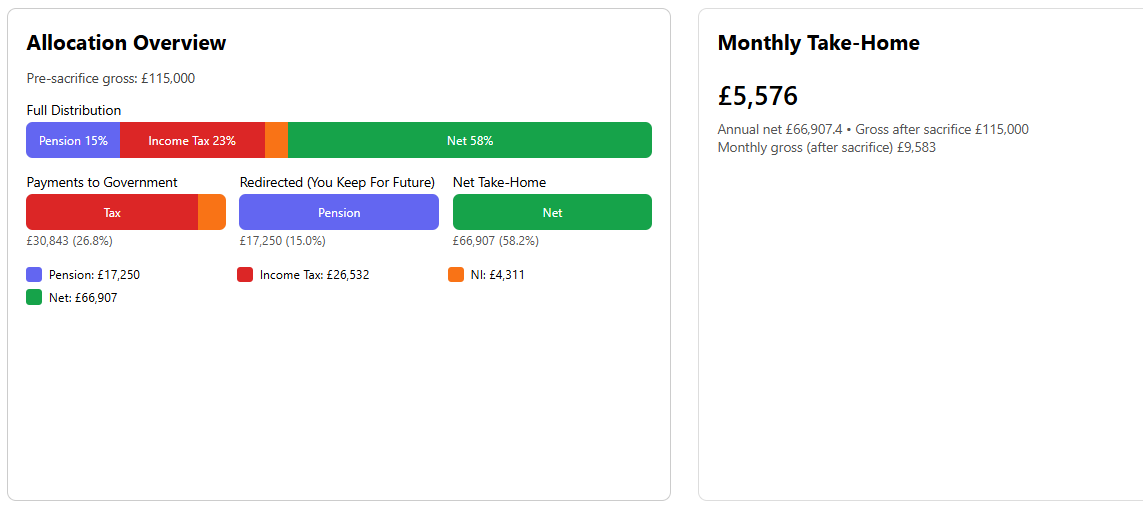

Now, use the tool to increase your pension contribution by say 10 percent. Instantly, you’ll see:

- Your taxable income drops below the taper threshold.

- Your personal allowance is fully restored.

- The tax you “save” is far greater than the pension amount you contribute—sometimes over half of each extra pound.

- Take home has taken a small drop but look at that pension contribution. You’ll be happy about that in the years to come

This Isn’t Aggressive Tax Avoidance

It’s simply understanding the rules as written and using them deliberately:

- Pension contributions (within annual allowance)

- Salary sacrifice (properly documented)

- Child Benefit preservation

- Clear visibility of trade-offs

What It’s Not (Yet)

- Dividend layering

- Share scheme optimisation

- Student loan stacking

- Gift Aid interplay

- Scottish/Welsh rate divergence

Those will come—once the core stays fast and trustworthy.

Why Build It Now?

Because the marginal pound of energy you spend before breakfast shouldn’t be wasted decoding taper math.

Because telling your future self “I just never looked” is a rubbish strategy.

And because the system won’t get simpler—so tooling must get clearer.

Call to Action

Try it. Move one slider. Feel that flicker of control return. Then decide:

- Do I redirect more now?

- Do I restructure my bonus?

- Should I push HR for salary sacrifice on the upcoming scheme?

Clarity compounds—financially and mentally.

Footnote (Quiet but Important)

This is informational, not personal tax advice. Complex cases (tapered annual pension allowance, MPAA, adjusted income > £260k, etc.) need a professional check. But you deserve transparency before you reach for paid advice.

Want to see EV and cycle-to-work modelling appear next? That’s on the roadmap.

Let’s retire “I think?” from every UK tax sentence we say this year.

(And yes—it really did start at 6:00 a.m. while the house was still half asleep.)